27 Apr Financial Trauma is Real: Healing Our Relationship with Money

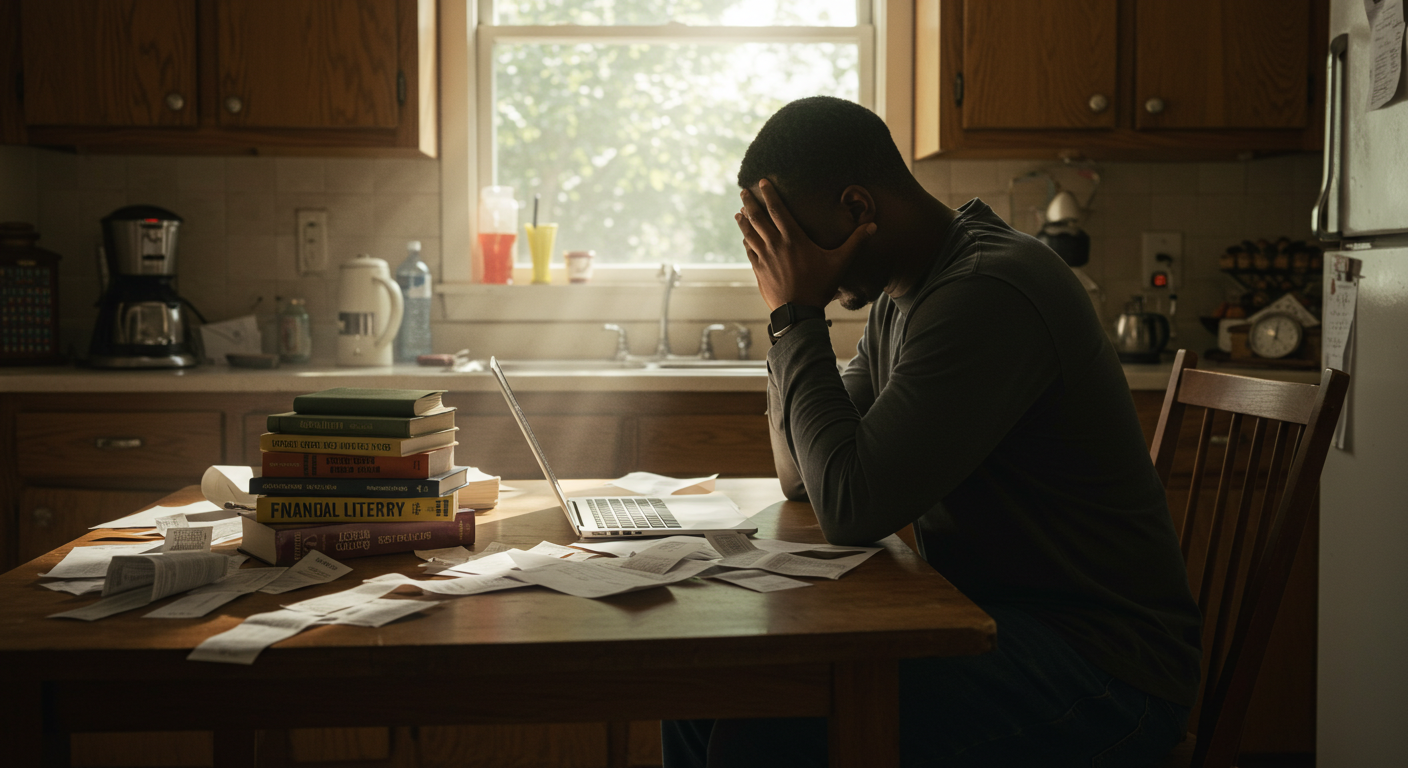

Money isn’t just numbers in a bank account—it’s deeply emotional. For many, financial struggles aren’t just about making ends meet; they carry psychological wounds from past experiences, shaping behaviors, fears, and even self-worth. Understanding financial trauma and taking intentional steps toward healing can transform our relationship with money from one of stress to empowerment.

What Is Financial Trauma?

Financial trauma occurs when money-related experiences create lasting emotional distress. It can stem from:

- Poverty or Unstable Finances – Growing up in financial insecurity can lead to persistent anxiety, even after circumstances improve.

- Systemic Discrimination – Barriers to wealth-building, such as redlining, wage disparities, or lack of access to resources, leave deep scars.

- Sudden Loss or Economic Hardship – Job loss, financial scams, or medical debt can create overwhelming fear and shame.

- Generational Money Struggles – If past generations faced financial instability, unhealthy money beliefs may be passed down unconsciously.

Signs of Financial Trauma

Financial trauma manifests in different ways, including:

- Avoidance: Ignoring bills, financial planning, or money conversations due to overwhelming stress.

- Guilt & Shame: Feeling undeserving of financial success or struggling with excessive guilt around spending.

- Scarcity Mindset: Constant fear of losing money, leading to extreme frugality even when unnecessary.

- Impulsive Decisions: Overspending, financial self-sabotage, or avoiding budgeting due to emotional triggers.

Healing Your Relationship with Money

1. Acknowledge and Identify the Root Causes

Recognizing financial trauma is the first step toward healing. Reflect on past money experiences, systemic influences, and personal triggers. Naming these emotions can help shift them from unconscious fears into actionable insights.

2. Challenge Harmful Money Beliefs

Rewrite limiting narratives, such as:

- “I’ll never be financially secure.” → Shift to “I can build financial stability, step by step.”

- “Rich people are selfish.” → Shift to “I can use financial success to uplift my community.”

3. Build Financial Literacy Without Judgment

Empower yourself through financial education—whether it’s learning about budgeting, investing, or wealth-building strategies. Approach it with curiosity rather than fear.

4. Practice Emotional and Financial Boundaries

Set boundaries around spending, financial conversations, and relationships that create money-related stress. Prioritize financial decisions that align with your values and well-being.

5. Seek Community & Support

Healing is more powerful in connection. Join financial wellness groups, seek guidance from trusted mentors, and share experiences with others navigating similar challenges. Collective knowledge and support make the journey easier.

Transforming Financial Trauma Into Strength

Healing from financial trauma isn’t just about numbers—it’s about reclaiming emotional security, confidence, and empowerment. A healthy relationship with money is possible, and it starts with self-compassion, education, and intentional healing.

No Comments